Introduction

Small and Medium Enterprises (SMEs) play a crucial role in India’s economic growth by creating jobs and driving industrial development. With relatively low capital investment, SMEs contribute significantly to employment generation and entrepreneurship. As of 2022, over 66 lakh new enterprises have been registered across the country, highlighting their growing presence.

While most SMEs rely on private funding, they also have the option to raise capital from public investors by going public through an Initial Public Offering (IPO). In recent years, SME IPOs have gained traction in India, providing small and medium businesses with a valuable opportunity to secure funds and enhance their market presence. The availability of dedicated SME listing platforms has further simplified the process, making it easier for these businesses to access public investment and scale their operations.

Meaning of SME IPOs

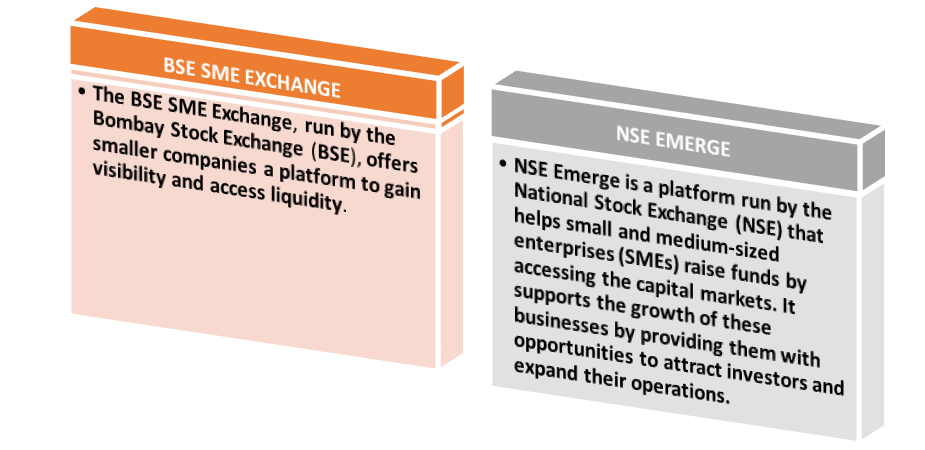

An SME IPO (Small and Medium Enterprise Initial Public Offering) refers to the process where a small or medium-sized business raises funds by selling its shares to the public for the first time. This allows SMEs to access capital from investors, expand their business, and increase their market presence. In India, SME IPOs are facilitated through specialized platforms like NSE Emerge and BSE SME, which are designed specifically for small businesses. By going public, SMEs can benefit from better funding opportunities, increased credibility, and higher visibility in the market. An SME IPO (Small and Medium Enterprise Initial Public Offering) is a way for small and medium-sized businesses to raise funds by selling their shares to the public for the first time. This helps SMEs secure the capital they need for growth, innovation, and strengthening their position in the market.

Classification

As per Micro, Small and Medium Enterprises Development Act, 2006; Small and Medium enterprises (SMEs) are classified as;

| Small | The investment in plant, machinery, or equipment does not go beyond ₹25 crore, and the total turnover remains within ₹100 crore. |

| Medium | The investment in plant, machinery, or equipment does not exceed ₹125 crore, and the total turnover remains within ₹500 crore. |

Eligibility criteria

- Post paid up capital – should not exceed ₹10 crore. However, if it falls between ₹10 crore and ₹25 crore, the company can still proceed with an SME IPO, provided it meets the specific requirements set by the SME Exchange(s) where the securities will be listed.

- The company must have a track record of earning distributable profits in at least 2 of the last 3 financial years.

- The company should have a positive net worth.

Listing platforms

Criteria for listing

| Particulars | BSE SME | NSE EMERGE |

| PAID UP CAPITAL | Should not exceed ₹25 crore. | Should not exceed ₹25 crore. |

| NETWORTH | The company must have a net worth of at least ₹1 crore for the last two full financial years. | There is no minimum requirement, but the net worth must be positive. |

| NET TANGIBLE ASSETS | The company must have net tangible assets of at least ₹3 crore in the last full financial year. | Not specified |

| LEVERAGE RATIO | Should not exceed 3:1, with some relaxation for finance companies. | Not specified |

| TRACK RECORD | The company should have a track record of at least 3 years. However, if it is applying for listing, it must have operated for at least one full financial year. If the company does not meet the 3-year track record requirement, the IPO project should be financed by NABARD, SIDBI, or another financial institution (excluding cooperative banks). | The company applying for listing must have a track record of at least three years. If the company itself does not meet this requirement, its promoters, a promoting company (whether based in India or abroad), or a previously existing Proprietary/Partnership firm that later converted into a company can fulfill the three-year track record requirement for listing. |

| OPERATING PROFIT (EBIT) | The company must have generated profits from operations in at least 2 of the last 3 financial years before applying. | The issuer must have an operating profit (EBITDA) of at least ₹1 crore from operations in any 2 of the last 3 financial years. Additionally, the company should have a positive Free Cash Flow to Equity (FCFE) in at least 2 of the 3 financial years before applying. |

Why Should SMEs Consider an IPO?

- Getting listed on the stock exchange acts as a public validation of the company’s financial stability and strong governance. This added credibility can help attract strategic partnerships, potential acquisitions, and a wider customer base.

- An IPO allows SMEs to access a larger pool of investors, securing the capital needed for business expansion, research and development, and the adoption of new technologies.

- When a company is listed on an exchange, it creates a marketplace where its shares can be bought and sold easily. This allows existing investors to convert their holdings into cash while giving new investors a chance to participate in the company’s growth. Increased liquidity benefits both the company and its shareholders by boosting investor confidence and overall value

LISTING PROCESS

| STEP | Stage | Description |

| 1. | Assessing Suitability | Evaluate if the SME meets eligibility criteria for IPO listing. |

| 2 | Appointment of a Merchant Banker | Hire a SEBI-registered merchant banker to manage the IPO process. |

| 3 | SME IPO Application | Submit application to stock exchange for IPO listing approval. |

| 4 | Drafting of the Prospectus | Prepare a detailed prospectus outlining business, financials, and risk factors. |

| 5 | Red Herring Prospectus (RHP) | File RHP with SEBI and exchanges for investor review (without price details). |

| 6 | Roadshow | Conduct presentations to attract potential investors. |

| 7 | SME IPO Launch | Open the IPO for public subscription. |

| 8 | SME IPO Allocation | Allocate shares to investors based on demand. |

| 9 | SME IPO Listing | List the company’s shares on the SME platform of the stock exchange. |

| 10 | Post Listing | Comply with reporting and governance requirements after listing. |

Conclusion

SME IPOs in India have emerged as powerful tools for small and medium enterprises to raise capital, expand operations, and drive innovation. These platforms provide crucial funding that helps businesses grow while giving investors access to promising, high-growth companies. Supported by the Indian government’s initiatives and ongoing improvements, SME IPOs are contributing significantly to the country’s economic development. However, SMEs still face challenges such as stricter listing requirements and lower liquidity compared to mainboard companies. To maximize the impact of SME IPOs, it is important to simplify regulations, raise investor awareness, and create a supportive ecosystem. With these efforts, India can strengthen its SME sector and build a more inclusive and dynamic economy.

Article Written by Monika Malhotra & Ojas Bangia

Feel free to connect for any query at 9599561517