INTRODUCTION

Becoming a registered real estate agent is a crucial step toward building a successful career in the real estate industry. Registration ensures that agents operate within legal guidelines, uphold professional standards, and provide trustworthy services to clients.

The registration process typically involves meeting specific eligibility criteria, completing educational requirements, and obtaining a license from the relevant real estate regulatory authority. This process helps maintain the integrity of the real estate sector and protects buyers, sellers, and investors.

WHAT IS RERA AGENT REGISTERATION

RERA Agent Registration is the process by which real estate agents and brokers register with the Real Estate Regulatory Authority (RERA) as per the Real Estate (Regulation and Development) Act, 2016 (RERA Act) in India. This registration is mandatory for agents who facilitate the sale or purchase of properties in RERA-registered projects.

The goal of RERA registration is to ensure transparency, accountability, and fair practices in real estate transactions. It helps prevent fraudulent activities and protects the interests of buyers, sellers, and investors.

BENEFITS OF RERA AGENT REGISTERATION

Legal Authorization

RERA registration gives real estate agents the official legal right to promote, market, sell, and facilitate the purchase of plots, apartments, or buildings that fall under the RERA Act. It ensures that agents operate within the law, making their transactions legitimate and trustworthy.

Boosted Credibility

RERA registration strengthens a real estate agent’s reputation among buyers and sellers. It demonstrates adherence to legal and ethical standards, making clients more confident in the agent’s reliability and professionalism.

Safeguarding Consumers

RERA registration protects buyers by ensuring transparency and accountability in real estate dealings. It promotes fair business practices, reduces the risk of fraud, and provides a legal framework for addressing complaints and disputes.

Exclusive Access to RERA Projects

Only RERA-registered agents are authorized to handle transactions for RERA-approved projects. This registration opens doors to a wider range of real estate opportunities, allowing agents to grow their business and work with reputed developers.

Regulatory Compliance

RERA registration ensures that agents follow the rules and guidelines set by the Act. It helps them stay informed about legal requirements, reducing the risk of violations and penalties while maintaining a smooth and lawful business operation.

Industry Recognition

RERA registration showcases an agent’s professionalism and commitment to the real estate sector. It sets them apart from unregistered agents, enhancing their reputation and credibility in the market.

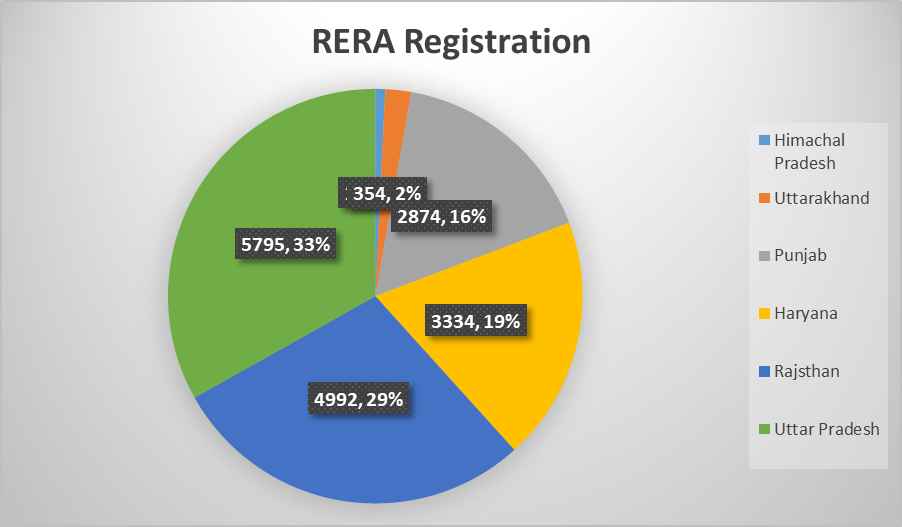

RERA AGENT REGISTRATION DATA IN NORTHERN STATES (AS OF MARCH 13, 2023)

As per data available with the Ministry, the northern states of India—including Himachal Pradesh, Uttarakhand, Punjab, Haryana, Rajasthan, and Uttar Pradesh—have the following RERA-registered real estate agents:

Why is the Demand for RERA-Registered Agents Increasing in Gurugram?

Gurugram, one of India’s leading real estate destinations, is witnessing a growing demand for RERA-registered agents due to several key reasons. The city is home to a wide range of residential and commercial projects, including luxury apartments, IT hubs, and business centers.

With increasing investments from NRIs, corporate buyers, and individual investors, the need for registered agents has grown, ensuring safe and transparent transactions. Property buyers in Gurugram are now more aware of RERA regulations and prefer to work with certified agents to avoid legal risks.

Past incidents of property fraud have also made buyers more cautious, leading to a higher demand for agents who are legally authorized under RERA. Additionally, ongoing metro expansions, expressway developments, and smart city projects are fueling real estate growth, attracting more investors and developers who rely on RERA-registered agents for compliance and professional guidance

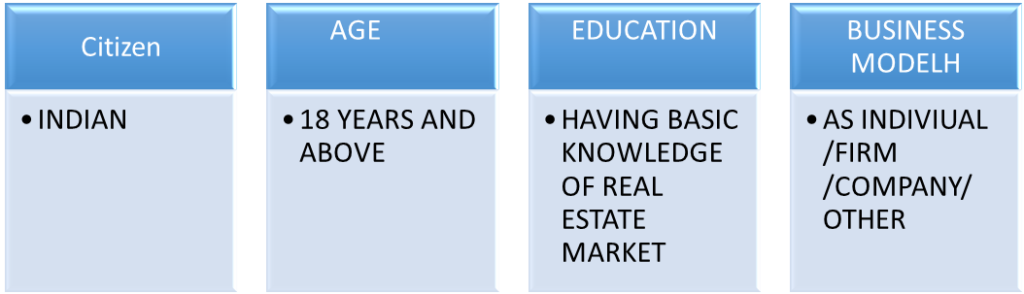

ELIGIBILITY CRITERIA FOR REAL ESTATE AGENTS

KEY POINTS ABOUT RERA-REGISTERED AGENTS IN GURUGRAM

| S.No Key Factor Details 1 High Demand for RERA Agents Rapid real estate growth has increased the need for legally registered agents. 2 Mandatory Legal Compliance Only RERA-registered agents can deal in RERA-approved projects as per HARERA regulations. 3 Increased Buyer Awareness Buyers prefer certified agents for safe and transparent transactions. 4 Protection Against Fraud Past real estate scams have made buyers cautious, increasing trust in registered agents. 5 Growing Investment Opportunities Rising investments from NRIs, corporate buyers, and individuals require professional RERA-certified agents. 6 Infrastructure Development Metro expansions, expressways, and smart city projects are driving real estate growth. 7 Better Business Prospects Developers, banks, and financial institutions prefer working with RERA-registered agents, boosting career growth. |

VALIDITY OF RERA REGISTRATION

A real estate agent’s RERA registration is valid for five years, unless it is revoked earlier due to any violation of regulations. During this period, the agent is required to maintain proper records, books of accounts, and financial statements as per regulatory guidelines. These measures help ensure transparency, accountability, and ethical business practices in real estate transactions

.RENEWEL OF LICENCE

Under the provisions of the Act, a real estate agent’s registration can be renewed upon submission of an application by the agent. This renewal process allows the registered agent to extend their license beyond the initial registration period.

PRESCRIBED FEES

OLD FEES

| S.no | TYPE OF AGENT | REGISTERATION FEES | RENEWL FEES |

| 1. | INDIVIUAL | 25,000 | 5000 |

| 2 | OTHER THAN INDIVIUAL INCLUDES COMPANY | 2,50,000 | 50,000 |

AS PER NOTIFICATION GIVEN BY TOWN AND COUNTRY PLANNING DEPARTMENT NOTIFICATION DATED 16TH MAY 2024 NEW FEES AS PER THE AMMENDMENT RULE OF 2024

| S.no | TYPE OF AGENT | REGISTERATION FEES | RENEWL FEES |

| 1, | INDIVIUAL | 50,000 | 10,000 |

| 2. | SOLE PROPERITORSHIP FIRM | 50,000 | 10.000 |

| 3 | OTHER THAN INDIVIUAL INCLUDES COMPANY | 2,50,000 | 50,000 |

CHECKLIST FOR REGISTERATRATION OF REAL ESTATE AGENT

| TYPE OF COMPNIES | CHECKLIST |

| INDIVIUAL | Pan Card ITR COPY IF ANY AFFIDAVIT ATTESTED BY THESILDAR OFFICE PROOF ATTESTED CHARACTER CERTIFICATE ADDRESS PROOF DIRECTOR GURRANTOR – WITH PROPERTY DEALER LICENSE PASSPORT SIZE PHOTO ID 4 PHOTOS |

| PVT LTD /FIRM / COMPANY | MOA AND AOA OF COMPANY COMPANY PANCARD TAX COPY COI ISSUED BY ROC LIST OF DIRECTOR ON LETTER HEAD DIR 12 BOARD RESOLUTION (ORIGINAL) ATTESTED CHARACTER CERTIFICATE OFFICE PROOF DIRECTOR ADDRESS PROOF Guarantor: with Property Dealer License, Passport size Photo and ID. 4 PHOTO OF EACH DIRECTOR |

PROCEDURE TO BE FOLLOWED FOR RERA AGENT REGISTERATION

Responsibilities of a Registered Real Estate Agent

- Transparency in Transactions: Agents must provide all necessary documents related to properties to clients, such as agreements, ownership details, and compliance certificates.

- Fair Practice: Agents are required to avoid any unethical practices like false advertising or misleading information about properties.

- Compliance with RERA Rules: Agents must adhere to RERA’s guidelines, which include providing a written agreement to clients, maintaining proper records of transactions, and submitting quarterly or annual reports to RERA as necessary.

- Prompt Resolution of Disputes: Agents should act as intermediaries in resolving disputes between buyers, sellers, and developers.

Penalties for Non-Registration

If a real estate agent operates without RERA registration, they could face legal consequences such as:

- Fines: Agents may be fined for non-compliance.

- Imprisonment: In case of serious violations, imprisonment can also be a penalty.

- Blacklisting: They may be prohibited from practicing as a real estate agent in that state.

CONCLUSION

The registration of real estate agents under the Real Estate Regulatory Authority (RERA) is a critical step toward ensuring transparency, accountability, and professionalism in the real estate sector. By obtaining RERA registration, agents gain legal authorization to facilitate transactions while adhering to ethical and regulatory standards that protect the interests of buyers, sellers, and developers alike.

RERA registration enhances an agent’s credibility, fostering trust and confidence among clients by reducing fraudulent practices and promoting fair dealings. It also ensures compliance with state-specific regulations, contributing to a more organized and efficient real estate market. Furthermore, registered agents must adhere to the ongoing compliance requirements, including timely renewals and adherence to RERA rules, to maintain their authorization and avoid penalties.

In conclusion, RERA agent registration is not just a legal formality but a fundamental necessity for those engaged in real estate transactions. It empowers agents to operate within a structured framework, ensuring fair trade practices while benefiting the overall growth and integrity of the real estate industry. By embracing this regulatory framework, real estate agents can enhance their professional standing and contribute to a more transparent and reliable real estate ecosystem.